tax payment forgiveness program

There is a dedicated Online Payment Agreement tool with which you can choose your. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

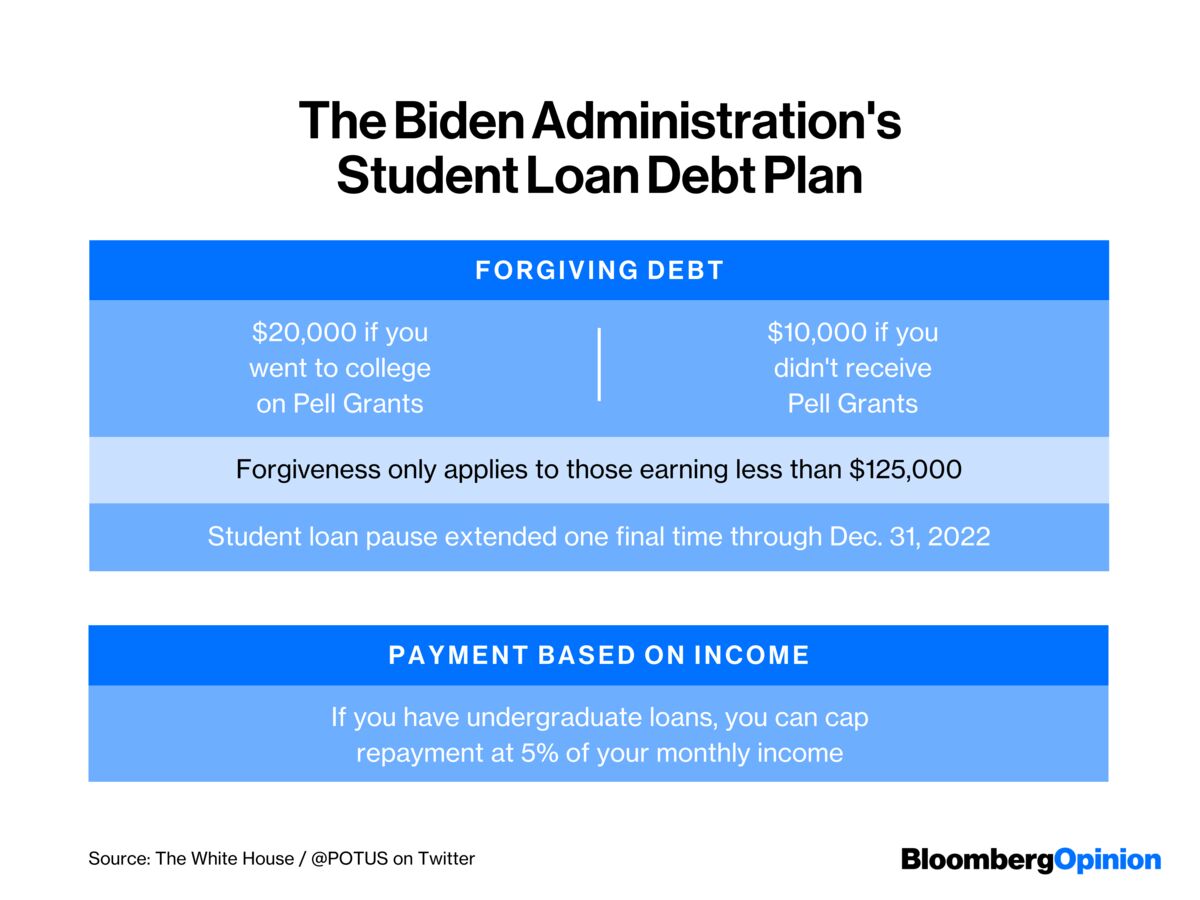

Student Loan Forgiveness Biden Plan To Cancel Debt Is A Costly Mistake Bloomberg

Appeals court on Friday temporarily blocked President Joe Bidens plan to cancel billions of dollars in college student debt one day after a judge dismissed a Republican.

. - Court temporarily blocks Bidens student loan forgiveness plan - Key dates for the Middle Class Tax. IR-2022-162 September 21 2022. The IRS has the final say on whether you qualify for debt forgiveness.

To that end were offering a wide range of taxpayer relief options. Our three main goals to help taxpayers are. After filing your tax returns you can proceed to the IRS website IRSgov to officially enroll in the program.

The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. First we want to do everything we can under existing rules for. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. The IRS offers several solutions for people who cannot afford to pay their full sum of back taxes.

A total tax debt balance of 50000 or below. Generally if you borrow money from a commercial lender and the lender. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits.

The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will. IRS debt forgiveness is for those with a debt of 50000 or less. Real Property Tax Forgiveness Program.

This means that the IRS or state tax agency agrees to settle your tax debt for less than the full amount you owe. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF. If you pursue certain payment.

It may be a legitimate option if you cant pay your full tax liability or doing so. Some of the biggest perks include. In general though the agency looks for taxpayers who.

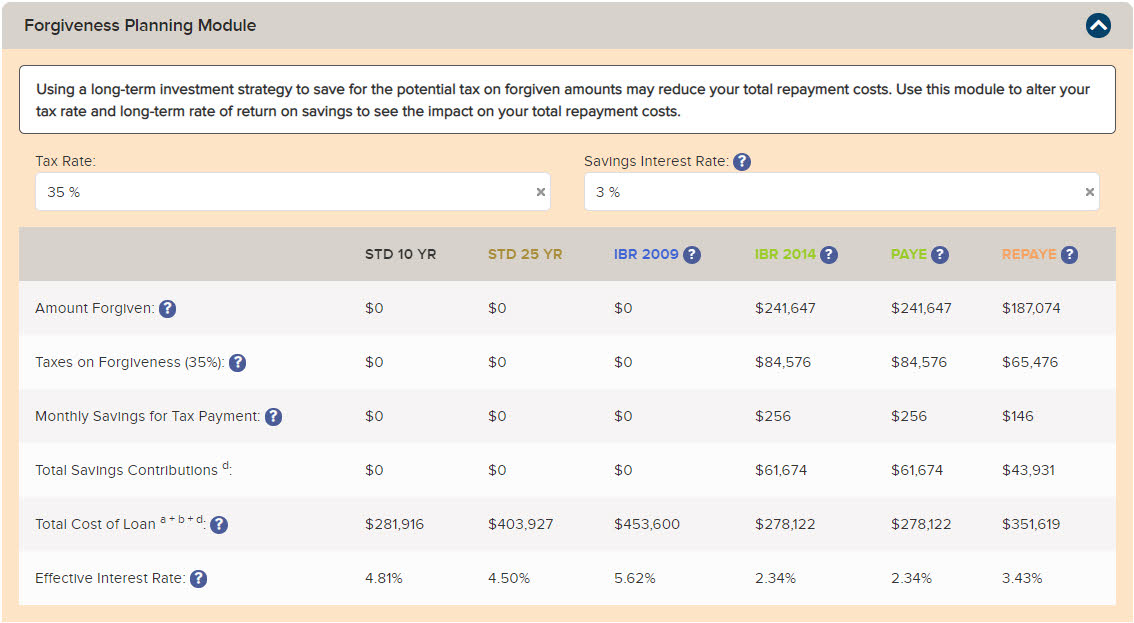

And program will increase the amount that is considered non-discretionary income to about 31000 from about 20000 protecting more of a persons income from going to debt. An offer in compromise allows you to settle your tax debt for less than the full amount you owe. They will assess your full financial picture to determine eligibility.

Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. On a general note each IRS tax forgiveness program considers the following factors. The OIC or Deal in Compromise is just one of the manner ins which the internal revenue service has created as a means to collect on the amount.

IRS debt relief is for those with a debt of 50000 or less. If you owe a substantial amount of. You can also apply for the IRS.

IRS Tax Forgiveness Program. Taxes which have been outstanding for more than 180 days PROVIDED THAT the owner of the. The IRS has 10 years to.

The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years. WASHINGTON The Internal Revenue Service recently issued guidance addressing improper forgiveness of a Paycheck Protection Program. 23 October 2022 - Does my state offer inflation relief checks.

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times

2022 Student Loan Forgiveness Program H R Block

Irs One Time Forgiveness Program Everything You Need To Know

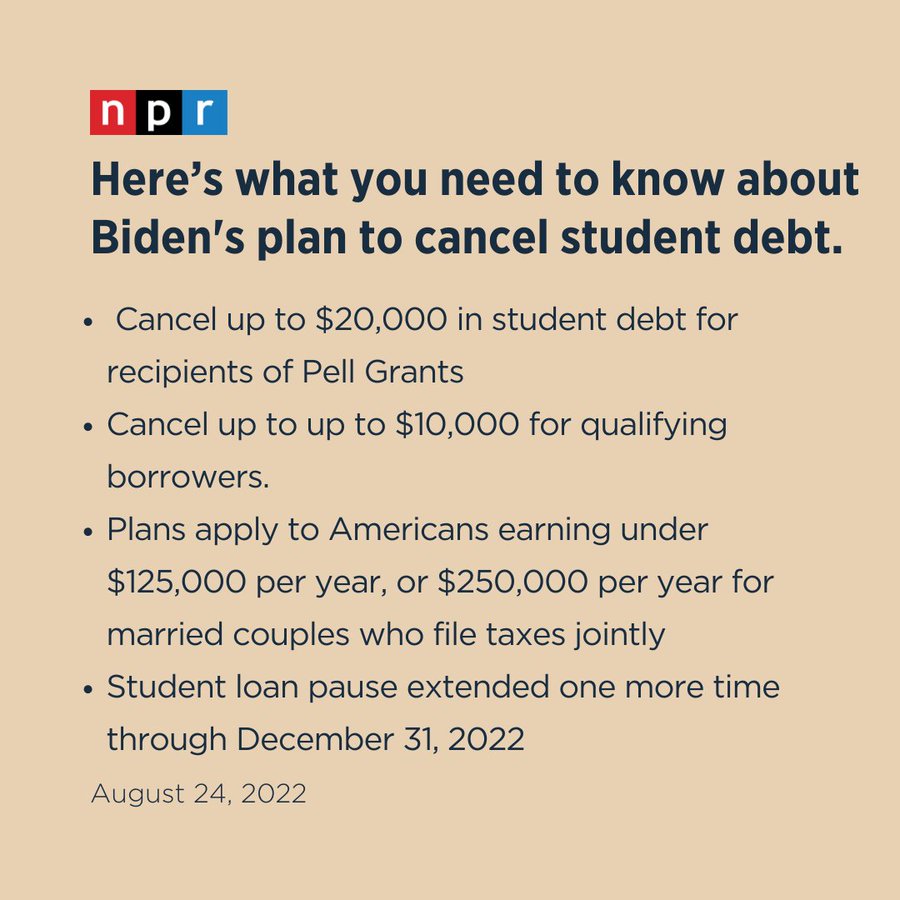

Biden To Cancel Up To 10k In Student Loan Debt For Borrowers Making Under 125k Npr

Forgiveness Planning Student Debt Center Vin

Student Loan Forgiveness Could Cost 2 500 Per Taxpayer Research Finds

Student Loan Debt Forgiveness Who Qualifies Application Deadline

Irs Tax Debt Forgiveness Program

Some States Could Tax Cancelled Student Loan Debt Kiplinger

Calameo Three Ways To Settle Or Resolve Your Tax Debt Advance Tax Relief

Californians May Have To Pay Taxes On Forgiven Student Loans Los Angeles Times

2020 Schedule C Self Employed How To Report Ppp Received Page 2

Tax Relief Questions And Answers Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

These States Could Tax Your Student Loan Forgiveness Time

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs